Step 4: Assign and Reconcile Costs

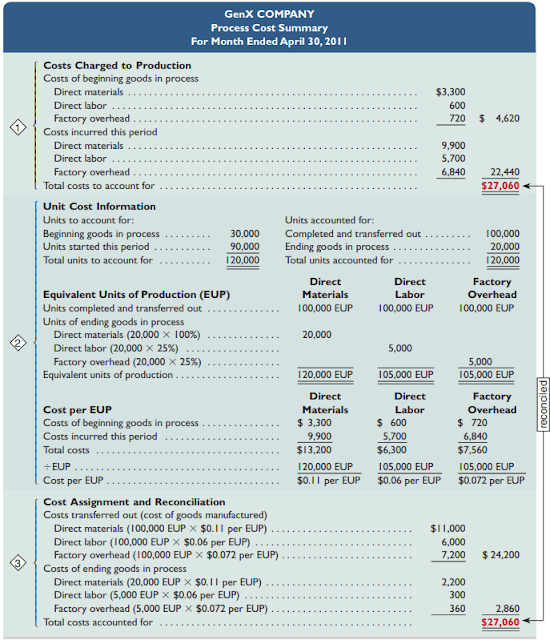

Step 4 uses the EUP from step 2 and the cost per EUP from step 3 to allocate costs to (a) units that have been completed and moved to finished products and (b) units that are still in progress. Exhibit 1 illustrates this.

Cost of Units Completed and Transferred

100,000 EUP of direct materials were required to complete and transfer 100,000 units to finished products inventory. As a result, we attribute a direct materials cost of $11,000 (100,000 EUP * $0.11 per EUP) to those units. Likewise, those units had received 100,000 EUP in direct labor and 100,000 EUP in manufacturing overhead (see Exhibit). As a result, we give those units $6,000 (100,000 EUP * $0.06 per EUP) in direct labor and $7,200 (100,000 EUP * $0.072 per EUP) in overhead. The total cost of the 100,000 finished and transferred units is $24,200 ($11,000 +$6,000 + $7,200), with a unit cost of $0.242 ($24,200 / 100,000 units).

Cost of Units for Ending Goods in Process

At the conclusion of the term, there are 20,000 unfinished units in the goods in progress inventory. Those units contain 20,000 EUP in direct materials. material (from step 2) at a cost of $0.11 per EUP (from step 3), resulting in the material cost $2,200 in goods in process inventory (20,000 EUP * $0.11 per EUP). In terms of direct work, the In-process units have 25% of the labor necessary, or 5,000 EUP (from step 2). Making use of the $0.06 The labor cost per EUP (from step 3) yields a labor cost of $300 for products in process inventory. (5,000 EUR * $0.06 per EUR) The in-process units reflect 5,000 EUP in overhead (from step 2). Using the $0.072 overhead cost per EUP from step 3, we get $360 in overhead expenses for in-process inventory (5,000 EUP * $0.072 per EUP). At the conclusion of the period, the total cost of goods in process inventory is $2,860 ($2,200 + $300 + $360).

As a check, management confirms that the overall costs allocated to finished and transferred units, plus the costs of those in progress (from Exhibit Previous), equal the production costs. The following exhibit depicts the costs incurred by production throughout this time period. The expenses accounted for in Exhibit Previous are then reconciled with the costs to be accounted for in Exhibit Next.

The production department manager at GenX is accountable for $27,060 in costs: $4,620 for items in progress at the start of the period, plus $22,440 for materials, labor, and overhead incurred during the time. That manager must indicate where these costs are apportioned at the conclusion of the term. According to the GenX manager, $2,860 is allotted to units in process and $24,200 is assigned to completed units. They are assigned to finished units. The total of these sums is $27,060. As a result, the total costs to account for match the total costs accounted for (small discrepancies are acceptable). This is occasionally caused by rounding.

Process Cost Summary

The process cost summary (also known as the production report) is an essential managerial accounting report for a process cost accounting system that is created independently for each process or production department. The summary exists for three reasons: (1) to assist department managers in controlling and monitoring their departments; (2) to assist factory managers in evaluating department managers' performance; and (3) to offer cost information for financial statements. A process cost summary accomplishes these goals by explaining the expenses paid to each department, providing the equivalent units of production attained by each department, and establishing the costs attributed to the output of each department. For our needs,

Exhibit Next depicts the process cost overview for GenX. There are three sections to the report. Section 1- summarizes the overall expenses incurred by the department, including direct materials, direct labor, and overhead expenditures, as well as the cost of the initial items in process inventory. Section 2- defines the department's comparable units of production. Separate columns show the equivalent units for materials, labor, and overhead. It also provides direct reporting.

Supply, direct labor, and overhead costs per equivalent unit. Section 3 distributes total expenses among units completed over the term. The entire cost of items transported out of the department is $24,200, while the cost of partially processed ending inventory units is $2,860. The assigned expenses are then combined together to demonstrate that the entire $27,060 charge to the department in section 1 is now assigned to the units in section 3.